What is auto insurance?

Auto insurance is a product that provides financial protection for cars, trucks, motorcycles, and other road vehicles from loss, physical damage and/or bodily injury liability resulting from traffic collision, theft or other losses.

An auto insurance policy is comprised of six different kinds of coverage. Most states require you to buy some, but not all of these coverages. If you’re financing a car, your lender may also have these requirements.

Most auto policies are for six months or a year. Your insurance company should notify you by mail when it is time to renew the policy and pay your premium.

By law, all drivers in Nevada must purchase auto insurance.

What Does Car Insurance Cover?

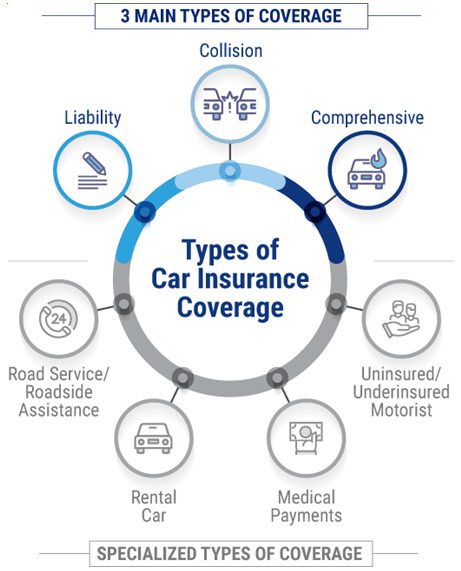

Your independent auto insurance broker in Las Vegas can help give you a clear, personalized picture of the coverage you need specifically for your car based on your unique situation. However, your policy will generally come with three main types of coverages.

The "big three" of car insurance coverage

- Liability: Liability insurance coverage protects you only if you are liable for an accident and pays for the injuries to others or damages to their property.

- This is typically broken down into three key limits: bodily injury per person, bodily injury per accident, and property damage. The liability limits that you choose—say $100,000/$300,000/$50,000 respectively—are basically the max the insurer will pay.

- Collision: This covers your own vehicle if it’s damaged in an accident. If the accident is ruled the other person’s fault, their insurance would pay for your damage. But if you cause the accident, or if you live in a no-fault car insurance state, your collision coverage will pay for the damage to your own vehicle.

- Comprehensive: Also known as Other Than Collision, this covers your own vehicle for almost any other type of damage it could receive, like theft, fire, vandalism, falling objects, windshield damage, and nearly anything that’s not wear and tear.

Additional car insurance considerations FOR AUTO INSURANCE IN LAS VEGAS

- Uninsured/underinsured motorist (UM/UIM): If you or your passengers are injured in an accident in which the other driver is at fault and either does not have insurance (uninsured) or does not have enough insurance (underinsured) to pay allofyour loss, this coverage pays for the medical costs of you and your passengers.

- Medical payments: This is paid out to you and anyone in your vehicle if you suffer injuries in an accident. This is considered no-fault insurance, so it doesn’t matter who caused the accident or how—if you got hurt in your car, you’re eligible.

- GAP coverage: Because cars depreciate so quickly (especially immediately after purchase) and insurers only pay current market value, GAP coverage can help pay the difference between purchase price and your remaining loan balance.

- Convenience assistances

- Rental car costs: If your car is being fixed after an accident, this coverage will pay for you to rent a car, up to a certain limit.

- Roadside assistance: If you become stranded on the road, your insurance company will help provide assistance for free.

- Towing expense: Different from roadside assistance, this will only reimburse you for towing expenses after the fact, not provide the service.

An auto insurance policy is comprised of six different kinds of coverage. Most states require you to buy some, but not all, of these coverages. If you’re financing a car, your lender may also have requirements.

Most auto policies are for six months or a year. Your insurance company should notify you by mail when it’s time to renew the policy and to pay your premium.

Why do you need auto insurance?

- If you’re in an accident or your car is stolen, it costs money, often a lot of money, to fix or replace it.

- If you or any passengers are injured in an accident, medical costs can be extremely expensive.

- If you or your car is responsible for damage or injury to others, you may be sued for much more than you’re worth.

- Not only is having insurance a prudent financial decision, many states require you to have at least some coverage.

Questions to ask your agent

Your Independent Agent is an advocate for finding auto insurance that meets your specific needs. Here are a few things to consider as you prepare for the discussion:

- How much can you afford to pay if you get in an accident? (To keep premiums low you may want to have a higher deductible and be willing to pay more for repairs.)

- What is the insurance company’s level of service and ability to pay claims?

- What discounts are available? (Ask about good driver, multiple policy and student discounts.)

contact us

We respect your privacy. Your information will be sent securely and handled with care. View our privacy policy.